Quantifying the Value of Financial Advice

Robert Craig: September 21, 2023

In the world of financial advice, proving its worth is often nebulous. In a study I've been reading, Vanguard has attempted to do this and has delved into understanding the tangible value of such counsel. Their findings suggest that while value is inherently subjective, aspects of financial advice can be objectively quantified, depending on the unique market circumstances and the client's specific context.

A Changing Landscape in Financial Advice

As the industry shifts towards fee-based models, there's an inclination to quantify an advisor's value in yearly terms, juxtaposing fees for advisory relationships against the yearly value provided. Yet, the true value propositions of financial advisors manifest sporadically, primarily during market extremes. It is in these moments that advisors can deter clients from hasty decisions, potentially saving them significant financial setbacks over the long run.

Measuring the Immeasurable

How does one measure the advantage of counsel that persuaded a client to persevere during a bear market or the nudge to rebalance assets when it felt counterintuitive? The difference in clients' performance when they adhere to their investment plan, rather than deviate from it, doesn't manifest on their financial statements. We can't measure or monitor the alternate histories that might have unfolded had different decisions been made. We only measure and observe the implemented decisions and their outcomes, despite other viable alternatives.

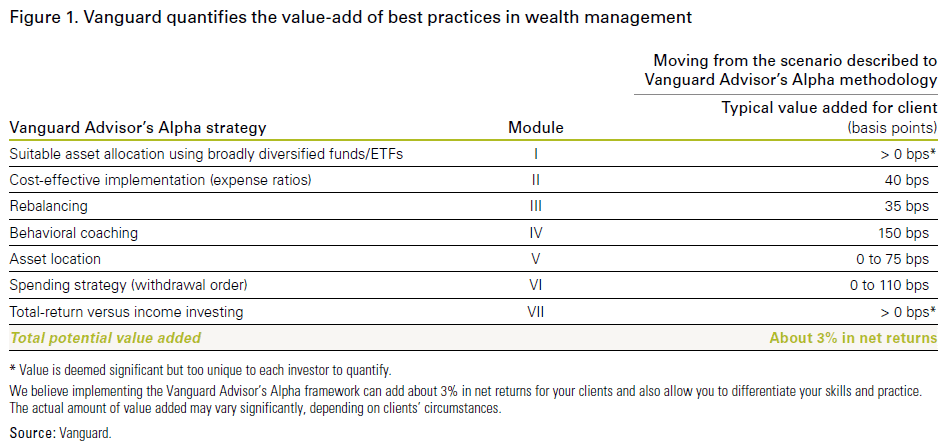

The report further compares two scenarios: portfolios managed adhering to best practices in wealth management versus those that aren't. While outcomes will vary, the discrepancies in potential results become evident.

Value Perception: A Subjective Territory

An intriguing question posed by the study revolves around perceived value. Why might someone deem a particular car or service more valuable than another? Similarly, Vanguard's "Adviser's Alpha" attempts to gauge this elusive concept. For some, advisors are a sanctuary from the overwhelming options in the investment world. For others, they might serve as reliable tax strategists, potential savers of unnecessary financial outflows.

Similar reasoning applies to other household services, such as painting, house cleaning, or landscaping. These services are often considered "negative carry" services, where the value is primarily emotional rather than financial. Clients might not easily quantify the financial value in advance, but they appreciate the convenience and peace of mind they bring.

Performance, then, becomes a focal point. But what is "better"? As the study references, many active fund managers fall short in consistently surpassing benchmarks. If we ignore performance and assume it is inline or better than a benchmark. Additional value emerges in guiding investors through tumultuous times, ensuring they stay the course and benefit in the long haul.

The Emergence of the Vanguard Adviser's Alpha

The study distils its findings into seven pivotal modules (Figure 1), aiming to demystify the potential value additions advisors can bring. According to Vanguard, by harnessing these modules, advisors can offer a value addition of around 3% in net returns. This increase should not be viewed as an annual value-add, but is likely to be intermittent.

Vanguard's overarching message stresses the significance of a tailored approach. Just as every individual is unique, so is their financial journey. As such, financial advice should be more than an off the shelf strategy; it should be an adaptable tool, moulded to suit each client's distinct needs and aspirations.