Q1 2024 Review

Robert Craig: April 29, 2024

Market Commentary

As the year started, we referred to the bullish sentiment that equity investors had for the year ahead in contrast to the start of 2023, when all around feared the worst as inflation rates were heading higher interest rates the same way and fears of a global recession were abound. Towards the latter half of 2023, inflation rates had started to fall back towards the US central bank's 2% target, and the US economy had remained remarkably resilient in the face of restrictive monetary policies, partly assisted by some fiscal help from Mr Biden. Equity sentiment was very different from the start of 2023. Hopes the Chinese economy will recover as the authorities add monetary stimulus and continue to ease COVID restrictions, adding to the sense of optimism. The expectation was that inflation would continue to fall, and the Federal Reserve could make as many as six cuts to interest rates in the coming year; along with all that, the AI growth drive was still very much at the forefront of people's minds. Goldilocks was to return home.

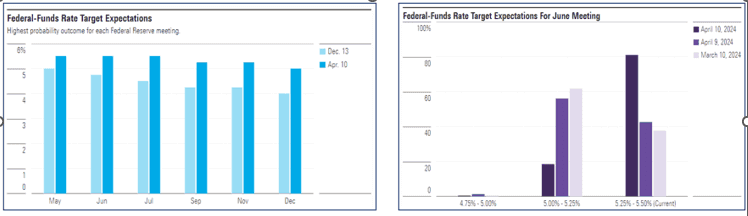

So far, that optimism for the stock market has been borne out, as US indexes have hit record highs on multiple occasions in the first three months of the year. There have been signs of a modest slowdown in the US economy, but the soft landing scenario remains the favoured outcome. On the negative side, US inflation rates have disappointed on the downside, and as a result, the expectations are now for a maximum of three cuts this year, the first of which is expected in June; however, those odds are also lengthening.

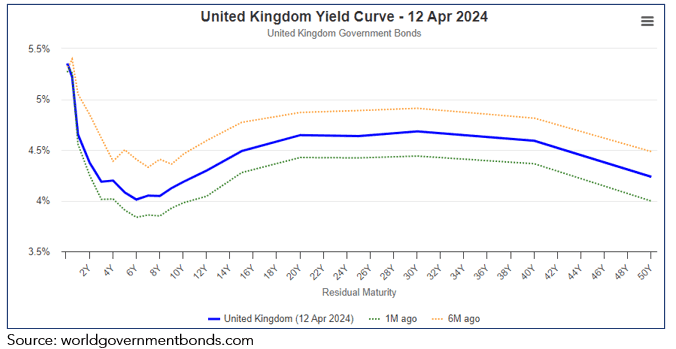

Bond markets have not fared well this year as growth and inflation have impacted yields. The two-year US yield curve remains inverted as a sign that all may not be well with the US economy, as one is supposed to be rewarded for the extra duration risk.

The oil price, which has been trading between 70 and 80 dollars a barrel, started to creep higher in the latter half of the first quarter as political tensions increased and the OPEC production cuts started to impact it. There were some concerns that the political uncertainty had impacted global supply chains as shipping routes were disrupted; that has not been the case till now. The tech influence in leading US indexes has waned slightly. As a result, sector performance has broadened. Gold has remained in demand this year, outperforming the S&P 500, despite higher yields, which is counterintuitive to what one usually expects when rates stay higher for longer

Investment Strategies

Total Return Balanced

We made some portfolio changes, adding Kone, the elevator company, and Honeywell, the US aerospace conglomerate, to the portfolio. As a result, we took some profits in Disney, Microsoft, Procter and Gamble, and Colgate held slightly higher levels of cash in the portfolio than we did at the start of the year. We continued to hold a selection of UK gilts, which currently offer an average yield to maturity of 4.5% on average. Currently, we have not gone beyond the summer of 2027. The overall portfolio offers a yield of just under 3.5%. One can see from the chart below how UK gilt yields have moved over the past 6 months, one month and where they are today across the curve.

Our best-performing stock this quarter was Disney, a testament to the effectiveness of Nelson Peltz's activist efforts in improving profitability. As the luxury goods name, Hermes continues to shine across all markets. SAP's strong numbers and the continued fair wind from the technology sector have also contributed to its performance. Microsoft and Alphabet also had a decent start to the year. While Reckitt Benckiser underperformed due to a court ruling against its subsidiary Mead Johnson, we believe the market has more than compensated for the potential loss. We added modestly to the position in the fall, acknowledging that any recovery will take time.

Global Macro

The portfolio slightly underperformed the Global high-risk and global indexes in this first quarter due to its higher weighting in the UK and China relative to global weightings. Both indexes have underperformed year to date, but we feel the valuation of UK equities and the potential for a recovery in the Chinese economy mean both are worth staying invested with current weightings

UK Income

The income fund continues to perform ahead of the STEPS low-risk benchmark. The portfolio's equity portion has contributed 1.74% to the performance, while bonds added 0.05% to the performance in the first quarter. The portfolio has an overall yield of 4.9%.

We have further reduced our exposure to 3i as the yield has fallen to 2% after a very strong performance in the equity. We replaced it with Lowland Investment Trust a yield of just over 5%, and trading at a discount of 10% of its NAV.

Market Outlook

Market sentiment has been stretched for most of the year as the hope that the Goldilocks economy materialises—lower inflation, lower rates, and a resilient pace of growth. This, along with the boost artificial intelligence, is expected to give global growth. US equities are expensive, but selling them purely based on valuations has been an error in past years. Having said that, US equities now account for 70% of the world's index, and the US economy is 26% of global GDP; in relative terms, that is a big gap. That gap can largely be explained by the heavy skew of the tech sector. In contrast, UK equities still look cheap, but chasing them again based on attractive valuations has been a fruitless exercise on many occasions over the past few years, but one get a sense the UK is starting attract some investor capital.

This year, energy, followed by technology, has been the best-performing sector, and real estate and utilities the underperformer as rates stay higher for longer. Inflation in the US is proving harder to bring back to the Fed’s 2% target; the latest CPI data reinforced this. In our view, US interest rates will still likely to be cut in June, but this may be the only time this year, as they are unlikely to cut again in July. August, the Fed does not meet. We are then approaching the presidential election, a politically sensitive time to change monetary policy dramatically. The Bank of England and the ECB are more likely to cut further as both economies are underperforming the US, and inflation rates are closer to their respective bank's targets.

In the short term, corporate earnings will be the focus as we enter the Q1 reporting season. Expectations, as is always the case at the start of the year, are modified, usually downwards, as the Christmas spirit wears off, and this year is no exception. Forecasters expect earnings growth year over year of circa 5% for the S&P 500 relative to the same period.

The price of oil is as likely to impact global equities in the coming months as much as interest rates; higher oil prices are a direct tax on the consumer and a brake on growth.

As is always we always remind ourselves times of uncertainty are the times of opportunity, and we must always be prepared for these times.

by portfolio advisor Paul Sedgwick