October 2023 Review

Robert Craig: November 9, 2023

By Portfolio Advisor Paul Sedgwick

Dear Partner

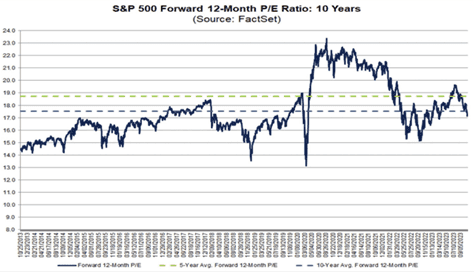

The past few months have been ones in which perhaps hope and reality have caught up with each other. The rally in stocks over the first half of the year was driven by a combination of a more resilient US economy, and the expectations AI would drive the next leg of growth. August, September and October have been months where earnings overall are meeting expectations, economic growth in the US remains stronger than anticipated. Despite this, stocks are being derated as markets concern themselves that the economic outlook will weaken from here, along with the adjustment higher interest rates do for equity risk premium, as one can see from the chart below. Adding in more recently the potential impact of the rise in geopolitical tensions, the equity markets remained understandably unloved.

Taking a quick look at the overall performance of asset prices in the past month; there has been limited moves in US treasury prices, but what was noticeable was the two-year US treasury yield fell back below 5%, post Wednesday’s Fed meeting, from 5.25% a month or so ago. The two-year maturity bond is always considered the most sensitive to changes in interest rate sentiment, this move would suggest speculators are starting to believe the US interest rate cycle have peaked. UK gilt yields also fell at the very short end, again suggesting speculators are believing we are close to the peak in UK interest rates. Small cap indexes underperformed large-cap indexes, a sign of concerns about the economic outlook. Gold rose on the month but oil fell back despite the increase in tensions across the Middle East. Defensive stocks outperformed more cyclical sectors, having said that no sector in October was in the blue. The US dollar, another asset considered a safe haven in times of economic uncertainty, fell on the month.

What was possibly most notable about October, was the lack of volatility in asset prices overall, despite, in particular, the increase in geopolitical risks. Even the selloff in equities was less dramatic than can be during periods of heightened uncertainty.

Total Return Balanced and Equity Portfolios

The month was dominated by the results season, which as always presents opportunities and reflection. Broader indexes lost anything between 2% and 4%, the MSCI all country index was down 2.4% (GBP).

Company Results update:

Briefly going through the companies in our portfolio that have reported so far;

Consumer staples companies have increased prices and seen modest volume declines, with P&G, Colgate-Palmolive, Nestle, Reckitt Benckiser, and Coca-Cola reporting revenue growth. The market was expecting better volumes, and management teams indicated that Q4 volumes would stabilise, potentially indicating less aggressive pricing. P&G saw strong earnings growth of 17% with the Healthcare division the top performing, Colgate saw 16% growth in EPS with growth driven by Latin America, Europe, and also its Pet food division. Hermes reported continued strength across the business supported globally by a stronger US and European consumer and strong Asia growth.

Estee Lauder reported results at the beginning of November, which saw revenue decline 10% in the latest quarter due to a reduction in its Asia Travel Retail Business. Estee Lauder has a broad portfolio of beauty brands and is in 150 countries but had guided the market lower due to the slow recovery in China travel. We continue to see longer-term value in the company as management have indicated an expected recovery in earnings next year. We do not believe there has been a structural change in Estee Lauder’s business model but we do acknowledge they face some headwinds at present.

Healthcare results were mixed across our portfolio with Sanofi’s management announcing a spinoff of its consumer health division, following a similar path that both J&J and Glaxo have taken. The new entity will be separately listed with Sanofi retaining an equity stake. Sanofi management also adjusted their capital allocation for R&D spend but didn’t commit to future sales projections in 2025 and beyond, only indicating that the pipeline was strong, and that revenue growth would be similar in 2024 and 2025. Merck and Johnson & Johnson both reported 7% sales growth and adjusted earnings growth of 22% and 19% respectively.

While Microsoft and SAP beat estimates and reported strong cloud services growth, Alphabet results led to some profit taking despite beating revenue and earnings estimates with sales growth of +11% and EPS of +46%. Alphabet were not the only one of the “Magnificent 7” to see corrections in stock prices despite strong earnings beats. Texas Instruments had guided analysts of a decline in revenue this quarter due to broadening industrial weakness and some automotive growth. Cash generation remains robust although lower than last year.

Rio Tinto reported modest volume decline and pricing increases in the quarter as management indicated continued momentum in delivering results. Analysts are still highlighting economic slowdown and global slowing demand as a headwind for results going forward. Lockheed Martin reported increased sales and lower earnings, with several contract wins, but reported inflationary pressures and labour and supply chain challenges.

Our portfolio companies continue to report in November, and we will highlight these in the next month’s report. We did make some modest adjustments to the portfolio as we have decided to reduce our exposure to very short-dated gilts and move out exposure to longer-dated bonds taking advantage of higher yields for longer. We also added to Disney taking it up to 2% as we noted the interest from activist Nelson Peltz, and increased Lockheed Martin to 2% at a price of just over 400 dollars a share. We removed one of the Ishare corporate bond holdings, that was added to provide some income in the time when it was hard to come by. Again we added to the Jan 2026 gilt.

Outlook

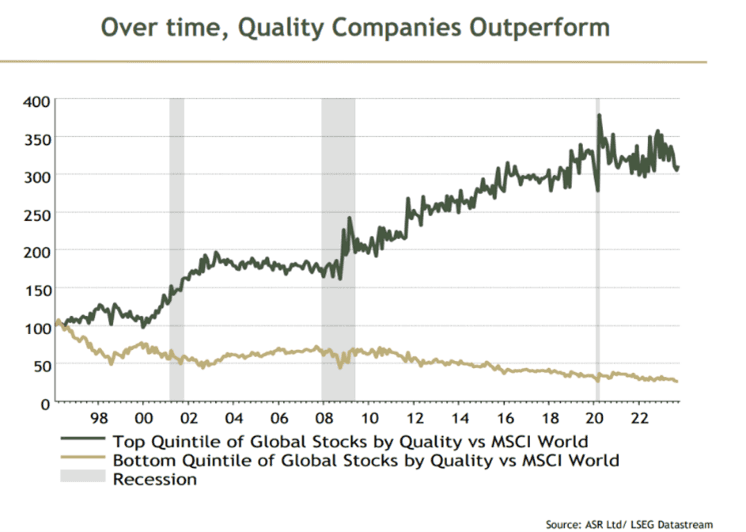

Looking to the final few months of the year, at present, there feels little that may drive the 5.6 trillion dollars that have been deposited into money market funds this year back into so called riskier assets. On the plus side sentiment is depressed, economic activity particularly in the US remains robust and those who wanted to de risk their portfolios have done so. When sentiment does change there could be quite a rush for investors looking to move away from bonds and into equities. These are the times just to be patient and always remember times such as this are when the opportunities occur. There is no doubt after three straight months of negative returns in the equity market there is room for something of a recovery, despite the uncertain outlook. On a final note we wanted to share a chart produced by Absolute Strategy which underlines the performance of quality companies against a broader index. This is core to our investment philosophy.

Yours sincereley

Cube Capital