Navigating the UK Government Bond Market

Robert Craig: January 19, 2024

A Guide for Investors in a Changing Interest Rate Landscape

In the ever-evolving world of investments, one question frequently asked by investors is, "Should I buy bonds?" This query becomes especially pertinent when considering the current economic environment where interest rates stand at 5.25%, with expectations of a decrease to around 4% in the next 12 months.

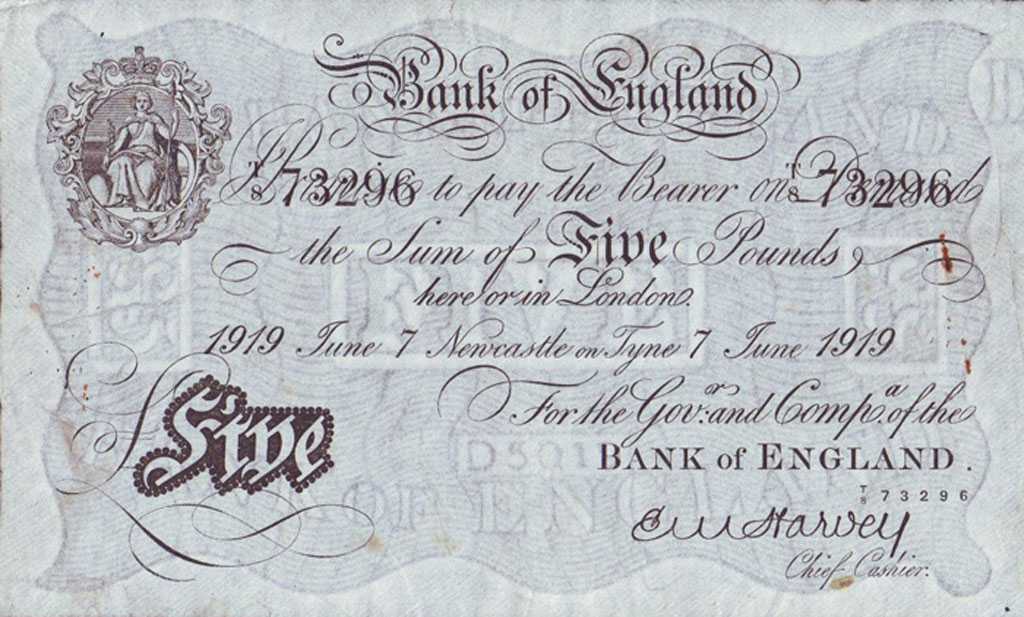

Understanding UK Government Bonds

What are UK Government Bonds?

UK government bonds, also known as gilts, are debt securities issued by the British government to raise capital. Investors essentially lend money to the government in exchange for periodic interest payments and the return of the principal amount at the end of the bond's term.

Returns in the Current Interest Rate Environment

The attractiveness of government bonds often hinges on prevailing interest rates. With rates at 5.25%, UK government bonds offer a fixed interest payment, providing investors with a stable income stream. However, as interest rates are expected to decrease to approximately 4% in the coming year, potential investors should weigh the impact on their returns.

When interest rates fall, the value of existing bonds tends to rise, as they offer a higher yield compared to newly issued bonds. This can lead to capital appreciation for bondholders. Conversely, in a rising interest rate environment, existing bond prices may decline, potentially causing losses for investors looking to sell their bonds before maturity.

Tax Efficiency Considerations

Another critical aspect for UK investors contemplating government bonds is tax efficiency. The interest income from government bonds is subject to income tax, which can significantly impact returns. However, UK government bonds enjoy certain tax advantages. Whilst interest from bonds to paid gross. Gilts are completely free from capital gains tax, which means you do not have to pay CGT on any profits you make when you sell or redeem the gilt.

The Decision-Making Process

1. Assess Your Risk Tolerance:

Before diving into government bonds, evaluate your risk tolerance. While these bonds are generally considered low-risk, market fluctuations can impact returns.

2. Consider Your Investment Horizon:

The term of government bonds varies, from short dated 1 year bonds to long dated 60 year and the ideal investment horizon depends on individual financial goals. Longer-term bonds may offer higher yields but come with increased interest rate risk. Similarly, being able to “lock” in a favourable interest rate on a short dated bond can be a good way to secure a fixed return.

3. Keep an Eye on Market Conditions:

Stay informed about market conditions and economic indicators. If interest rates are expected to decrease, existing bond prices may rise, potentially presenting a buying opportunity.

4. Diversify Your Portfolio:

While government bonds provide stability, a well-diversified portfolio is essential for risk management. Consider blending bonds with other asset classes to achieve a balanced and resilient investment strategy.

In the current environment where UK interest rates are the highest, they have been for a number of years gilts look very appealing. The stable income, potential for capital appreciation, and tax advantages make them an attractive choice. However, investors must carefully assess their risk tolerance, investment horizon, and consider tax-efficient strategies to optimise returns. As always, seeking advice from financial professionals is recommended to make informed decisions aligned with individual financial goals and market conditions.

For details on Cube Capital's Gilt investment portfolio please see "UK Income" on the "Strategies" page