May 2024 Review

Robert Craig: June 7, 2024

This past month or so has clearly demonstrated what the overriding driver for stocks, particularly in the US, has become. Resilient economic data and solid earnings season help support stocks, but what is becoming more apparent is equities are more and more sensitive to where rate expectations go. We saw yields rise in April and stocks dip as inflation rates remained sticky. Towards the latter half of April and early May, stocks rallied as yields fell after the monthly inflation data came in moderately ahead of expectations, or at least no worse. As May wore on, stocks again came under pressure as US two-year treasury yields, which had fallen below 4.75% at one point in May, were again hitting closer to 5%. They last were at this level in April; the S&P 500 was 6% lower. We appear to be heading back to a 2 tier equity market as in the past week; all US major sectors fell except for technology and communication services, helped by Nvidia results provided something of a buffer to sentiment.

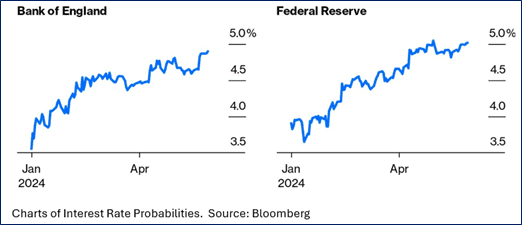

On the positive side, May’s monthly flash PMI data indicates that the major developed economies are showing signs of gaining further growth momentum midway through the second quarter. A healthy economic outlook is helping support US stocks and their loftier-than-historical valuations, but it's struggling to push them higher in the face of fading rate cut expectations. One can see from the charts below how interest rate expectations have changed since the start of the year.

We are now heading into months of polling; the first will be the European elections in June, something that seems to have taken the back burner in the minds of many investors. Europe seems to be lurching to the right as we appear to be moving left. Then comes the UK in July, at present it looks like a change in government is on the cards, and it’s hard to know how that will impact capital markets. So far sterling and

bonds have remained stable ahead of the July 5th. Then the focus will become what happens with the US elections. Central bankers were somewhat constrained during that time wanting to do little to influence economic sentiment.

Outlook

To sustain share prices, we probably need a return to what many affectionately call the Goldilocks scenario, modest growth, easing inflationary pressures, and a supportive monetary policy. At present, we have a supportive economic backdrop. However, inflation is moving rather slower than had been hoped to the central bank's target of 2%. Having said that, on Friday, the core personal consumption expenditures price index rose 0.2% in April, the smallest gain of the year. While economies remain resilient, inflation becomes harder to control, and interest rate cuts are less likely, it's all a bit chicken and egg. If the economy slows, the central banks have more room to ease, but it becomes harder for companies to grow earnings.

Rising bond yields make equities less attractive as the risk premium narrows; this is particularly true for the US market, where the risk premium has narrowed significantly. UK equities have recovered from the start of the year, and they continue to look attractive relative to history, as do most small and mid-cap indexes. Market breadth has declined in the past month as the focus has again turned to technology. We are entering the summer months and the end of the second quarter. These months can often be volatile ones as liquidity tightens.

On the brighter side, US markets are now coming close to a point where they have capitulated on any rate cuts this year but continue to discount the possibility that rates could go higher from where we are. So the story is not if we are at the start of a rate easing cycle but when that cycle starts and if the soft or no landing, as some commentators now describe the outlook, will be maintained as inflation comes nearer to their 2% target. This coming week, the ECB may be the first of the major developed regions to cut rates at their monthly meeting.

Yours sincerely

Cube Capital

by portfolio advisor Paul Sedgwick