January 2024 Strategy Review

Robert Craig: February 6, 2024

Dear Partner

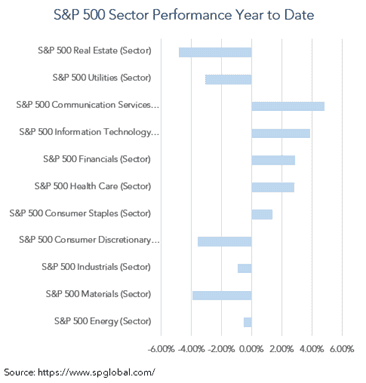

2024, as we noted in our last update, has started on a very positive footing, quite contrary to this time last year. This optimism has driven the S&P 500 to record levels; however, despite some moderate diversification into alternative sectors, the focus remains on the Magnificent 7. Aside from the technology sector, other sectors remain well below their previous highs. Tesla's results reminded us that these stocks come with their risks, as the company has lost almost 25% of its value from the start of the year. Microsoft and Meta with their rewards, the former strong revenue growth and the latter returning large amounts of cash to its shareholders. Earnings season for the fourth quarter has so far been a mixed bag, with the probability over all that earnings may come in slightly below expectations for the S&P 500 for the fourth quarter.

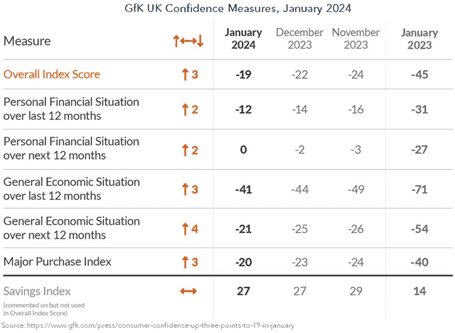

The US inflation outlook indicates that pricing pressure is still falling; the latest Personal Consumption Expenditure Index on a 6-month rolling basis is now below the Fed’s 2% target. Prices continue to fall, but the economy remains resilient as the US economy grew in the 4th quarter by over 3%, helped by a robust employment market and a confident consumer. The outlook for the UK economy is also improving as the Purchasing Managers’ Index preliminary readings for January showed another positive uptick in activity. The dominant services sector rose to 53.8 from 53.4 in December, while the composite measure improved from 52.1 to 52.5. Consumer confidence also improved in the UK: the GfK consumer confidence survey moved from -22 in December to -19 in January, its highest level in two years. In contrast, Germany, an economy largely driven by exports, languishes. As a result of the resilience of the US economy and the improving outlook for the UK, there has been a selloff in government bonds at the start of the year and a recovery in the US dollar.

The Vix remains close to historic lows despite signs geopolitical risks are increasing, which has resulted in a rise in the oil price at the start of the year. Equity markets tend to discount geopolitical risks as the outcomes can be many and hard to evaluate.

Portfolios

Bonds have seen something of a selloff across the curve after the strong end to the year. Our January 2024 gilt was redeemed at the end of the month, taking our cash levels up slightly; we will look to use the added liquidity to add to existing positions and divert some into some other fixed income assets.

We are deep into earnings season, and several of our companies have reported their numbers. Some of the outperformers this month are SAP, which has a strong earnings outlook, and Merck, which is boosted by strength in the sector and anticipation of another good earnings quarter, which it delivered on. Colgate, again after stronger earnings, has done well this month, and Disney helped by stronger streaming numbers from Netflix. The laggards have been Burberry, Lockheed and Rio. The former two continue to struggle from the weakness in the Chinese economy, and the latter, Rio reflecting the weakness in the sector.

In the past month, we added Kone, the lift installation and servicing company. In a nutshell, the company has a stable revenue base from servicing alongside the more cyclically geared installation business. It is more exposed to the Chinese economy than many in its sector, but it is a quality company with a strong balance sheet and a global footprint. All the attributes we look for.

For full strategy performance please see factsheets here

Outlook

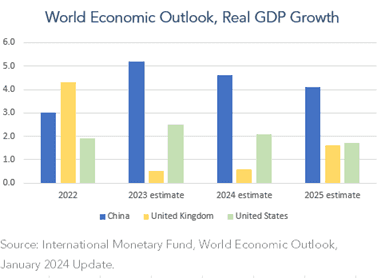

Despite some catch-up from the other indexes, there remains no doubt the love affair with US tech equities continues. The S&P 500 may be close to all-time highs, but this remains very much driven by the likes of Apple, Microsoft and Google. The Russell 2000 index of US smaller capitalised stocks remains below 2021 levels and has underperformed the large-cap index for the past eight years. The IMF upgraded its outlook for economic growth in 2024. There is much to focus the mind on; geopolitics remains in the headlines as Biden tries to navigate a response to the killing of three US soldiers, providing a robust response without unduly escalating tensions in the region and the oil price.

The IMF has raised their expectations for growth in the global economy this year, driven by the apparent resilience of the US economy, hopes that China’s stimulus will boost that economy and the ongoing strength of emerging markets. Interest rates will fall, and the additional monetary stimulus will help support the global economy. Part of me is reminded of the old adage that what seems too good to be true often is. Interest rates that nearly brought the global economy to its knees for 15 years appear to be barely making much of a dent this time around.

We have already seen some monetary policy easing in the past few months. Brazil, Chile, Hungary, New Zealand, Norway, Peru, Poland and South Korea, cutting on average by 1% as inflationary pressures have eased. The more developed central banks are likely to follow this year. The question is when, not if, and by how much, and what, indeed, will be the catalyst. Will it be the belief the inflation dragon is truly slain, or will signs of economic slowdown be the catalyst? Jerome Powell held firm on the line the Federal Reserve would start to ease monetary policy at some point this year but seemed to push back on March after the first rate-setting meeting of the year.

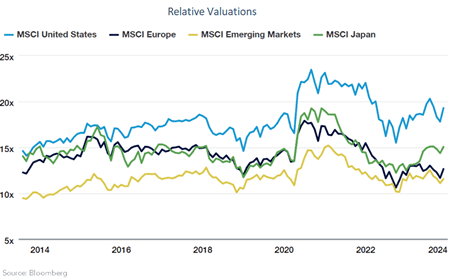

When looking at stock markets on the whole, the plus side to this focus on tech-related names is that it has resulted in quite a derating in the less sexy areas of the market. Most developed markets trade below their historical valuations, the FTSE all share and China’s CSI index in particular. We have tried to combine those two opportunities, adding to our portfolio of UK companies with a strong China influence.

Yours sincerely,

Cube Capital