What's better for stocks, Tories or Labour?

Robert Craig: May 3, 2024

I think firstly I should caveat that Prime Ministers have no direct control over the stock market or indeed monetary policy. It’s my view that PMs get too much blame and/or credit for the performance of the stock market. They clearly have influence over fiscal policy, government spending and taxation, but these are only a small amount of the many variables that can affect stock markets.

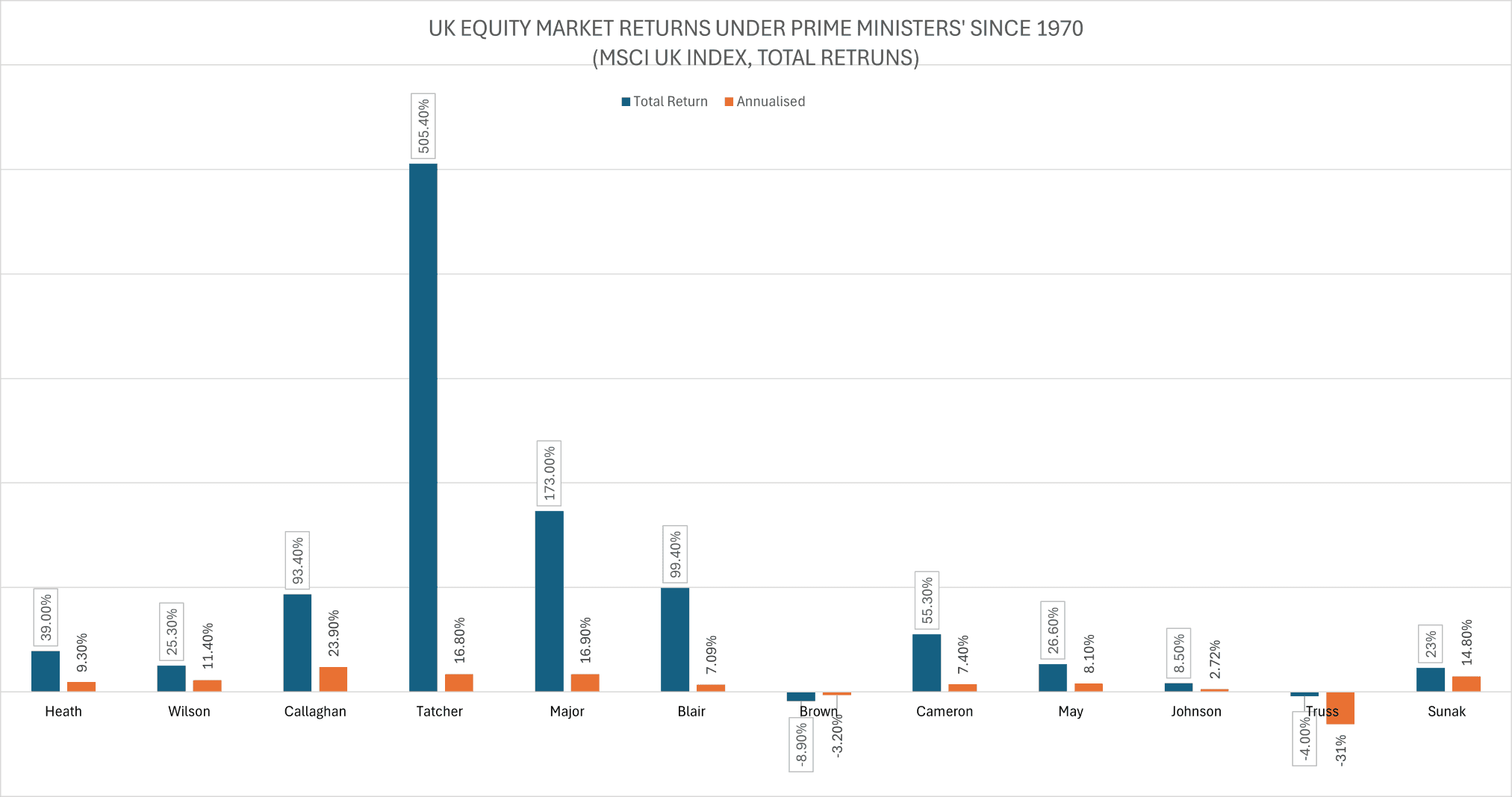

Having said that, commentators tend to put a lot of weight on how markets will react to new PMs and new governments. So, I have plotted all the prime ministers from 1970 to today and shown the total returns and annualised returns of the MSCI UK index during their premierships. I was tempted to leave Liz Truss off, having only been PM for 49 days, and therefore her figures and corresponding theoretical annualised return are somewhat skewed, but I have included her.

The annualised figures for Callaghan are the most impressive, coming in at a 23.9% annualised return. However, when he became PM, inflation was in double digits; during his premiership, this dropped down to single digits before spiking again during the winter of discontent, something that was seen across all major global economies. Thatcher is by far the most market-friendly PM in recent history. But how much of this 500% boom is down to her? It's hard to say. She was PM during a period of huge global economic expansion and deregulation. She was also voted out weeks before Black Monday in 1987, and the huge crash that followed would have dented her returns. It also shows that Gordon Brown was the worst (if we exclude Truss's theoretical annualised figure from her 49 days as PM!). But he took over when the global financial crisis was starting to crystallise, which sent global financial markets crashing.

It’s an interesting exercise to look at this, but the reality is that no useful conclusions can be drawn from the data. There are far bigger factors that influence UK equities than the political party in power. Also, the largest companies in the UK are global businesses and aren’t solely affected by domestic issues.

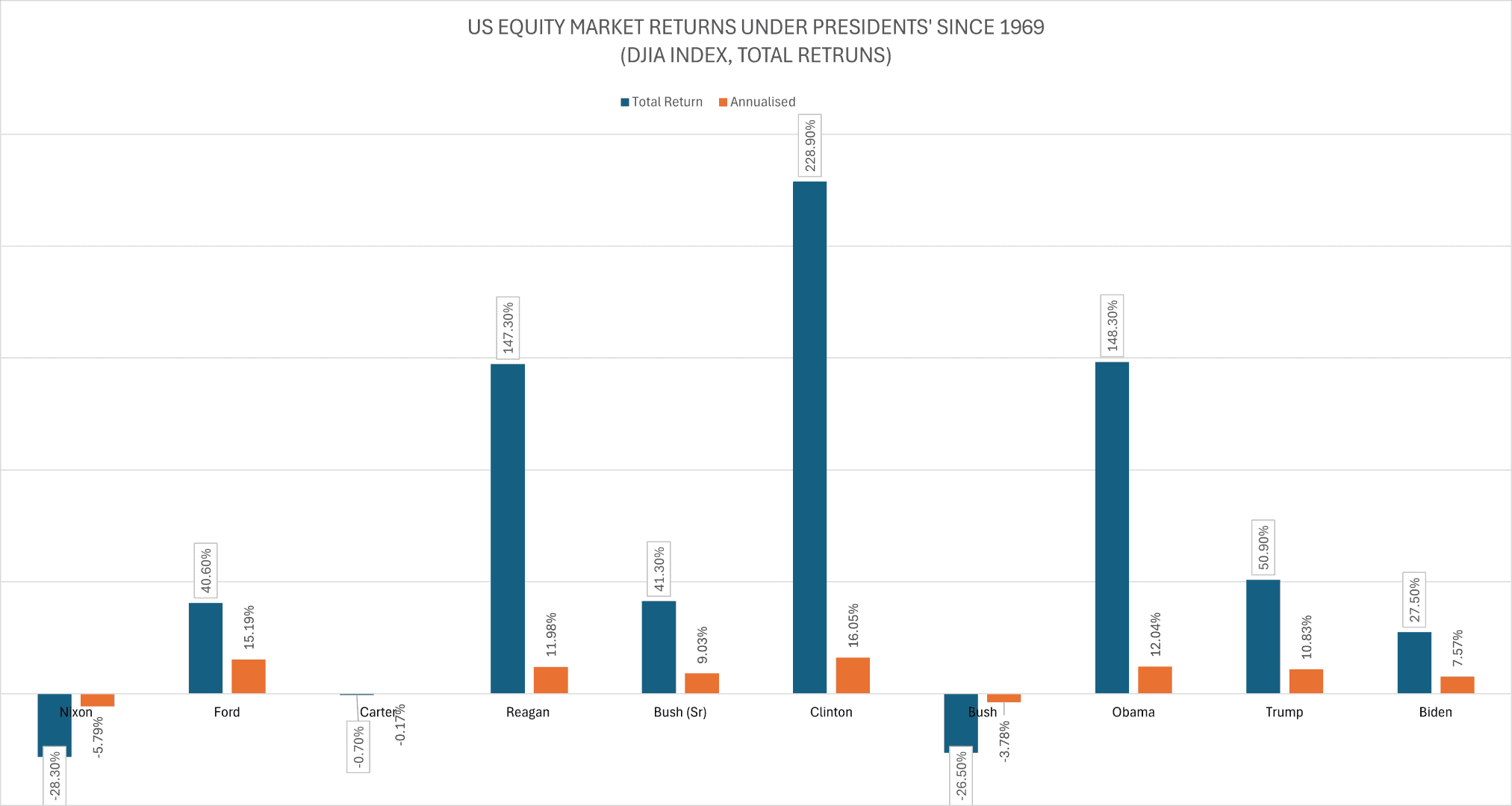

To that end, we can look at how Republic versus Democrat presidents have performed on the US stock markets. This is not quite as simple as the UK as the US may have one party holding the presidency but another in control of Congress. I have focused solely on the presidency for this exercise. I’ve used a similar timeframe and started with Nixon.

Based on this, the US markets have performed better under Democrats than under Republicans. As stated above, this does not imply cause and effect. George W Bush had to grapple with 9/11 and the Great Financial Crisis, Nixon huge civil unrest, and Reagan a trade war with Japan. Clinton’s term was boosted by inheriting ideal economic conditions in the 1990s, with inflation falling to 3%. Capping inflation saw a decade-long Wall Street expansion. These were after all the Alan Greenspan “irrational exuberance” years.

The most important thing to do when investing is establishing a long-term goal and strategy, holding a diversified portfolio across geographies, and trying to cut out the short-term noise.