February 2024 Review

Robert Craig: March 7, 2024

by Portfolio Advisor Paul Sedgwick

Dear Partner

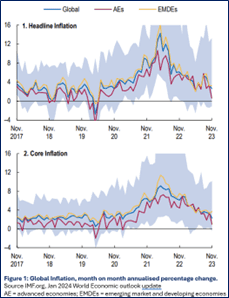

Another solid month for equity markets, as the love affair with the technology sector continues. Investors' focus has turned away from the expectation of imminent cuts in interest rates to the underlying resilience of the US economy. In contrast, large parts of the developed global economy continue to struggle under the weight of tighter monetary policy. GDP growth in the US averaged 0.8% q/q in 2023, compared to 0.0% and -0.1% in the eurozone and the UK, respectively. The World Economic Forum, in the 2024 report issued at the start of February, forecasts the global economy to grow in 2024 at 3.1% and 3.2% in 2025. It is supported by a more resilient US economy, several large emerging economies, and fiscal support for China. Global inflation is expected to fall to 5.8% in 2024 and 4.4% in 2025, concluding the risks of a hard landing have receded and the possibility that inflation rates falling faster than forecasts could lead to monetary easing.

Geopolitical risk remains, we recently passed the second anniversary of the war between Russia and Ukraine, and we are also very aware what is going on in the Middle East, including the impact on shipping routes. So far, there has been a limited impact on the global economy and investor sentiment, and this will probably remain the same whilst the oil prices appear unaffected. Commodity prices have generally declined since the COVID spike, helping inflation rates decline but also suggesting underlying demand may be weak.

The fourth quarter earnings season has ended, and the results underline the relative performance of Europe over the US as the latter’s corporate earnings grew year over year whilst those in Europe fell. S&P 500 companies had their highest quarterly earnings beat rate since the fourth quarter of 2021, helping support the ongoing rise in the S&P 500.

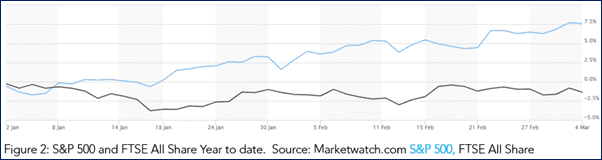

Fixed-income securities fell modestly again this month; however, we continue to see this as an opportunity to lock in these higher yields for longer. The UK fixed-income market is down 3% year to date.

Outlook

The S&P 500 has risen by 7% this year, reaching 15 new highs and simultaneously reaching several investment banks' targets for the year, encouraging them to become more optimistic for the year ahead. Investor sentiment is becoming stretched, but there are no obvious signs of excess leverage that usually dictates the market's peak. European equities have also had a decent start to the year; however, the FTSE all share continues to lag. Global Manufacturing PMIs indicate that global manufacturing is growing and emerging economies continue to outperform developed ones. The uptick in the global manufacturing output PMI in February points to some improvement in industrial production in the coming months. Interestingly, the US ISM Manufacturing index fell below expectations, as the major activity measures were mostly lower in February.

The US election looms ever closer, and part of me wonders if either leading candidate will lead their respective parties. At present, equity markets seem confident that either of the incumbent candidates will be positive for the economy.

Although yield curves have steepened since the start of the year, shorter-dated yields remain more attractive than the longer-dated ones. Traditionally, the longer you lend someone money, the more of a return you expect, the greater the risk you take and the more inflation eats into your gains. For this reason, economists consider an inverted curve to be a portent of troubles ahead. According to a Bloomberg report, bond markets have returned losses for investors for 8 of the last 10 months; however, equity markets remain undeterred. The question is will these higher shorter dated yields bite into stocks eventually?

The budget was released on Wednesday, and there have been signs that the UK economy is picking up as incomes are now rising faster than prices, easing the cost of living problems. However, the budget and looming election may influence that sentiment. Last week, we saw Nationwide’s seasonally adjusted measure of house prices rise by 0.7% month-to-month in February, above consensus of 0.3%, after gaining 0.3% in January.

It's probably fair to say there are modest signs that the eurozone economy is stabilising; at the same time, there may be a few possible signs of a slowing of the US economy. Chinese equities have recovered recently, hoping fiscal stimulus will boost their economy. Global equities do not look too far from historic valuations overall, and the lack of leverage in the system should help support any pullbacks.

Yours sincerely

Cube Capital

Past performance is not necessarily a guide to future performance. The value of investments and the income of any financial instruments mentioned may fall as well as rise, and investors may get back less than the amount originally invested. Fluctuations in exchange rates may have a positive or an adverse effect on the value of foreign currency denominated securities and financial instruments. Certain investments involve an above-average degree of risk and should be seen as long-term in nature. The investment products and services described may have tax consequences. Any tax reliefs referred to are those currently available and their value depends on the circumstances of the individual investor. You acknowledge that levels and bases of taxation may change, and that Cube Capital Limited does not provide tax advice. You should consult your own tax advisor in order to understand the tax consequences of the products and services described.