August 2023 Review

Robert Craig: September 8, 2023

By Portfolio Advisor Paul Sedgwick

Dear Partner

August can often be unsettling for capital markets; liquidity is poor, and as a consequence, volatility can increase. Equity markets finished the month recovering some of the losses from early August. The sectors taking the biggest hit: financials, technology, and consumer discretionary. Bond yields rose at the longer end but were little changed at the shorter end of the curve. The US yield curve remains inverted but slightly less so than where it was earlier in the year. The Brent oil price recovered back up to 85 dollars a barrel. It was generally a quiet month for commodity prices, and gold remains around 1950 dollars an ounce. The Vix spiked in early April but has slowly drifted back to its lows earlier in the year, indicating that investment confidence remains high.

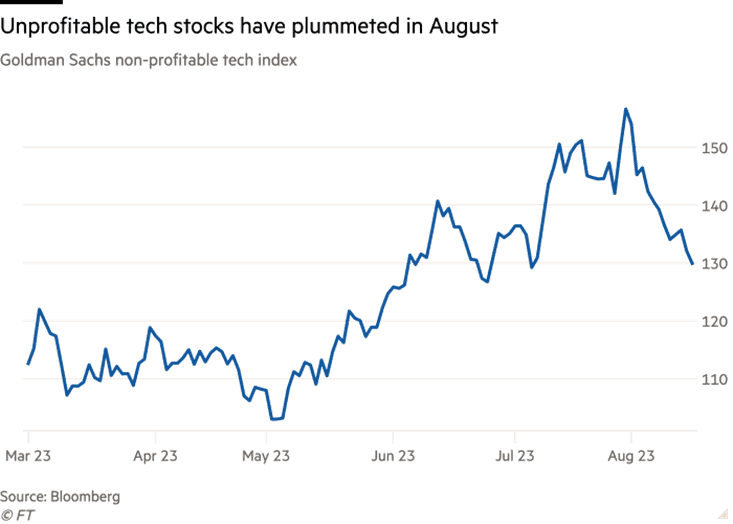

Six stocks in the S&P 500; Nvidia, Alphabet, Amazon, Microsoft, Tesla and Meta, have contributed over 70% of the year's gains. Rising yields are supposed to negatively impact growth stocks' returns, particularly in the technology sector. The focus on AI so far this year has led to a bucking of the trend; however, looking at the chart attached, it would appear higher yields are starting to bite into the performance of some parts of the sector, which may be a catalyst correction in the broader technology stocks.

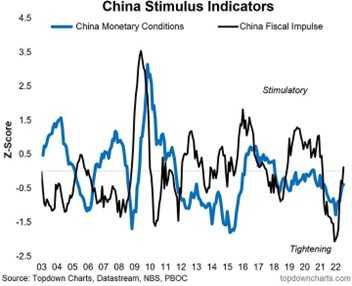

China's woes continue as the economy struggles to recover from Covid policies and the generally more restrictive policies of Xi Jinping. In particular, China's property market remains under strain as economists pull in their estimates for economic growth for the current year. So far there has been some policy response from the Bank of China, as one can see from the chart attached. If the economy continues to show signs of weakness one can expect policy makers to be more forceful.

Central Banks in the developed economies continue to deliver a hawkish message. In his Jackson Hole speech, Jerome Powell acknowledged inflation rates were trending back towards the Fed target. Still, he reminded the world that the Fed member's view remains that economic growth is too robust to bring inflation back to its 2% target. Mr Powell, therefore, did not rule out further interest rate rises in the coming months. However, there have been some signs that the jobs market is weakening in the past few weeks, which is likely to mean the Federal Reserve will pause at the September meeting. Despite many gloomy headlines circulating, the UK economy appears reasonably resilient. GDP growth for the 2nd quarter came in modestly ahead of expectations. With CPI inflation soon to fall below average earnings growth, the "cost of living crisis" appears to be easing. UK interest rates are forecast to peak around 5.5% but remain elevated for at least nine months.

Portfolio

The best-performing stocks over the month were SAP, Alphabet and Shell. Shell benefiting from the higher oil price, SAP continuing its momentum after a positive earnings report, Alphabet's new Chief Investment Officer appointment, and Google Cloud's role in benefitting the share price.

We added to Rio and Lockheed during the month, the former as the share price had lagged somewhat this year, and Lockheed as we took advantage of modest weakness to further build the position. Johnson & Johnson completed a share exchange to carry out a spin-off of its consumer healthcare business, Kenvue. Given the solid investment case and growth with the remaining pharmaceutical and medicaltech businesses, we have decided to hold Johnson & Johnson stock instead of exchanging shares in Kenvue. Ultimately, the relative valuation for Kenvue did not look that appealing, for a low growth company.

The laggards remain the names that have struggled this year; Estee Lauder continues to suffer from the weakness in the Chinese economy - EL remains a global brand leader, and we feel confident its fortunes will return as short-term issues fade. PayPal, we felt the market harshly treated the earnings report as they beat on both revenues and earnings; however, the market did focus on the falling number of active accounts as the payments space becomes more competitive. JP Morgan recently increased their target price to 100 dollars, reiterating their positive stance on the company. The company also appointed the new CEO, a senior executive from Intuit. Prudential stock price has suffered as investors focus on their China exposure; however, their latest earnings report was no worse than the market had anticipated.

Our portfolio consists of companies whose brands are known and respected worldwide, and we will continue to use that as our benchmark when considering new additions. Global brands have a solid competitive advantage in all economic climates.

Outlook

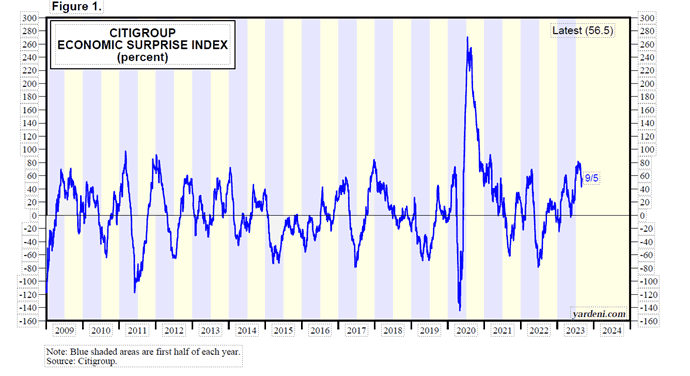

As we look to the coming months, there are some indications the US economy is starting to slow after many months of outperforming expectations. There are signs that the labour market is cooling, and the Citi economic surprise index is rolling over, reflecting that US economic data is now not meeting expectations.

A recent report from Capital Economics noted stress across core financial markets appears around as low as at any point since the Russian invasion of Ukraine started in early 2022, and risk premia have moderated over recent months on growing hopes of a "soft landing" in the US. That, we feel, is where consensus is at present, having been much more cautious earlier in the year.

If the global economy starts to slow, particularly the US economy, the relative performance for equity and bond markets will be between by how much it slows and how quickly central banks react. A sharper-than- expected decline and a slow-to-react central bank will impact risk assets. A soft slowdown and a central bank that gently starts to ease monetary policy will be more supportive. Historically, September is the worst month for stock market returns, but the correction usually paves the way for a year-end rally. It is fair to say with government yields where they are, it's hard to make a case for equities in the short term, although the UK equity market looks far better value than the US.

We have a solid base of equities and bonds in our portfolio. We have extended the maturities of the bond portfolio over the past weeks and months. Taking into consideration the prevailing top-down outlook, we will continue to monitor the portfolio for new opportunities.

Yours sincerely

Cube Capital